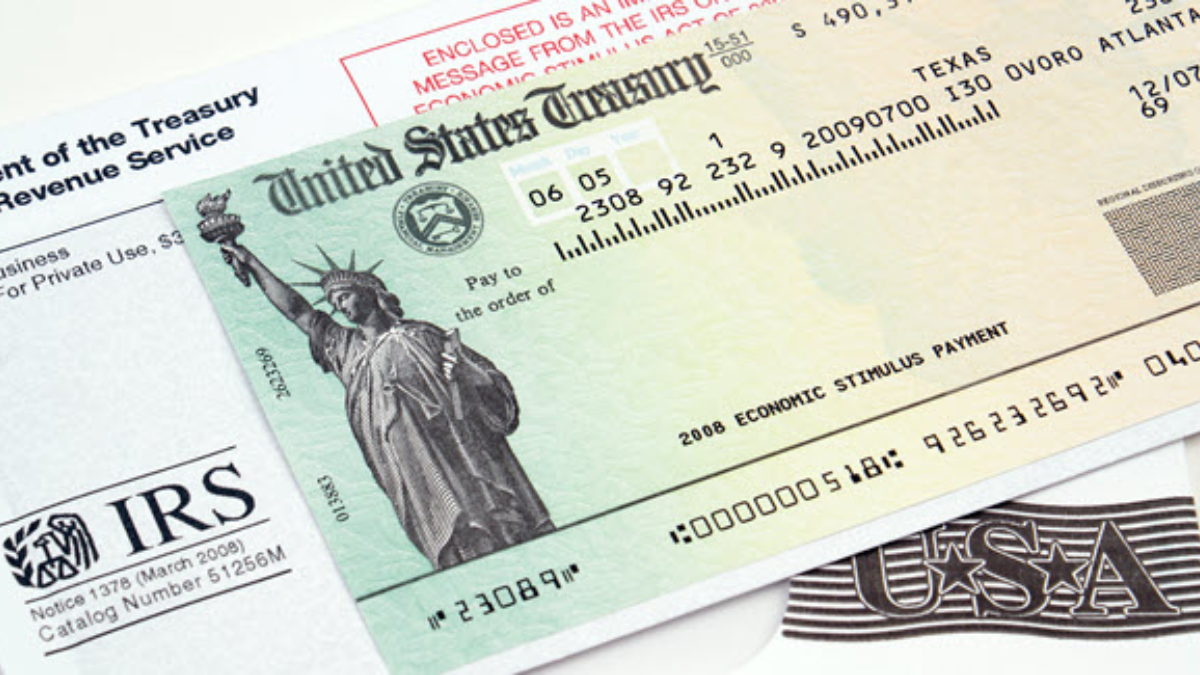

Many Americans may soon find an unexpected financial boost in their bank accounts as the IRS rolls out a surprise $1,000 refund. This new round of payments is part of a correction effort tied to tax overpayments, pandemic-era adjustments, and delayed credit processing. If you filed taxes in the last few years and met certain income or benefit criteria, you could be among the millions eligible.

Who Is Receiving the $1,000 Surprise Refund?

The IRS has identified specific taxpayers who overpaid due to errors in stimulus reconciliation, unemployment benefit taxes, or missed credits like the Earned Income Tax Credit (EITC). Eligibility extends to low- and middle-income earners, especially those who claimed dependents, experienced unemployment, or received benefits during the 2020 to 2023 tax years. You don’t need to reapply—if you qualify, the refund will be issued automatically.

Refund Distribution Timeline and Method

The IRS began processing these $1,000 surprise refunds in mid-July 2025, with deposits expected to continue through August 15, 2025. Most recipients will get the payment via direct deposit to the bank account used in their most recent tax return. If no direct deposit information is available, a paper check will be mailed to your registered address on file.

| Payment Method | Expected Delivery |

|---|---|

| Direct Deposit | July 15 – August 10, 2025 |

| Mailed Paper Check | July 20 – August 15, 2025 |

| IRS Refund Tracker | Update available in real time |

| Amount | $1,000 per qualified taxpayer |

How to Check If You’re on the Refund List

To confirm your eligibility or refund status, visit the IRS’s “Where’s My Refund” tool online or use the IRS2Go app. You’ll need your Social Security number, filing status, and exact refund amount (if known). Additionally, the IRS has sent out notification letters (Form 6419 or CP12) to qualifying taxpayers. If you receive one, it’s a strong sign that your refund is on the way.

Things to Keep in Mind Before Spending the Refund

Though this refund may come as a welcome surprise, it’s important to use the funds wisely. Consider using it to pay down debt, catch up on bills, or build emergency savings. Also, ensure your contact and banking information with the IRS is accurate to prevent delays or misdirected payments. If you recently moved or changed accounts, update your details on the IRS portal immediately.

The IRS’s surprise $1,000 refund initiative is providing real, tangible relief to millions of Americans without requiring extra paperwork or reapplications. This automatic refund corrects past errors and ensures eligible taxpayers receive what they’re owed. If you suspect you qualify, check your IRS account or refund tracker soon—your money could be on the way.

FAQ’s:

1. Do I need to apply for the $1,000 IRS refund?

No, the IRS is issuing these payments automatically based on prior tax records and credits.

2. How do I check if I’m eligible?

Use the IRS “Where’s My Refund” tool or check your mail for a CP12 notice from the IRS.

3. Can I update my bank account for direct deposit?

Only if your return hasn’t been processed yet. Otherwise, future IRS updates may allow this.

4. Will the refund be taxed?

No, this refund is a return of overpaid taxes—it is not considered taxable income.

5. What if I don’t get my refund by August?

You should contact the IRS or check the refund tracker. Some cases may require identity verification.