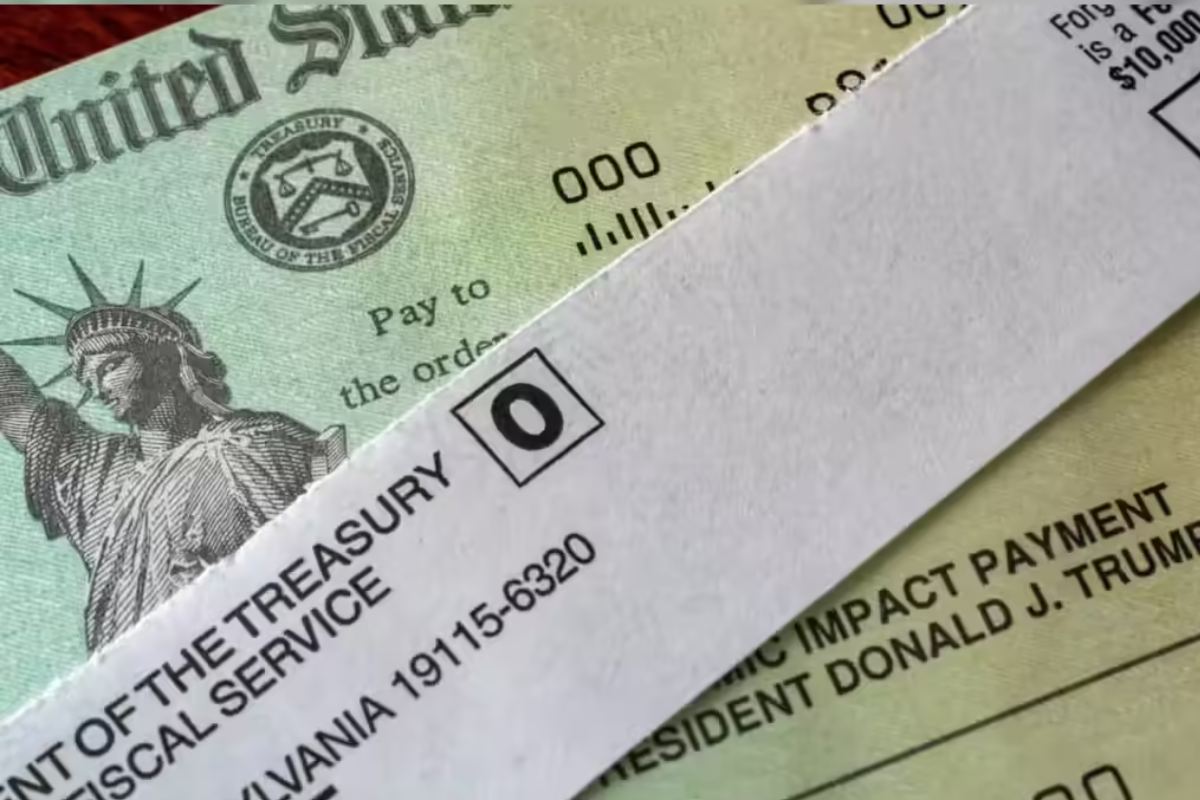

Seniors aged 65 and older are set to receive a $1,200 relief check this July as part of a federal effort to ease rising living expenses. Here’s how to confirm your eligibility, claim your payment, and understand when it will arrive.

Who Qualifies for the $1,200 Relief Check?

To qualify, you must be a U.S. citizen or legal resident, aged 65 or above by July 1, 2025, with a 2024 adjusted gross income (AGI) of $40,000 or less for individuals, or $60,000 or less for joint filers. Seniors receiving Social Security benefits (SSDI or SS) or veterans’ pensions automatically qualify if their AGI falls within limits, even if they didn’t file a tax return. Those relying solely on retirement income or SSI should submit the IRS non‑filer form by June 15, 2025 to ensure they’re considered.

When and How Checks Will Be Sent

The IRS will issue the $1,200 relief check via direct deposit or mailed check, depending on your filing details. Update your direct deposit information by June 25, 2025, to ensure you receive funds electronically between July 10–15, 2025. If your bank info is missing or outdated, paper checks will be mailed between July 20–August 10, 2025. Use the “Get My Payment” portal from July 1 onward to track your status and expected delivery.

| Event | Date / Window |

|---|---|

| Non‑Filer or Tax Filing Deadline | June 15, 2025 |

| Direct Deposit Info Update Deadline | June 25, 2025 |

| Direct Deposit Issuance Window | July 10–15, 2025 |

| Mailed Checks Sent | July 20–August 10, 2025 |

| Portal Tracking Available | Starting July 1, 2025 |

What You Should Do Now

If you don’t normally file taxes, submit the non‑filer form before June 15. All seniors should confirm or update their direct deposit details via the IRS portal by June 25 to avoid a mailed check. Starting July 1, log into “Get My Payment” to check your scheduled deposit or mailing window; the portal will show “Scheduled” or “Sent” status once processed.

What to Do If You Don’t Receive the Check

If you haven’t received your payment by August 20, 2025, revisit the IRS portal to check for flags like “Delayed” or “On Hold.” Delays can occur due to identity verification reviews or missing banking data. Follow portal prompts to resolve issues within five business days. If problems persist, contact the IRS Economic Impact Payment hotline at 1‑800‑919‑9835, with your Social Security number, AGI, filing status, and any portal messages ready for reference.

This July’s $1,200 relief check offers essential financial support for qualifying seniors. To ensure you receive it, file your return or non‑filer form by June 15, update your banking info by June 25, and monitor the IRS portal starting July 1. If any issues arise, act promptly to get your payment delivered on time.

FAQ’s:

1. Do I need to file taxes if I receive Social Security?

Only if you have other income; otherwise submit the non-filer form to claim the benefit.

2. Is this relief check taxable?

No—it’s non-taxable federal assistance, not subject to income tax.

3. What if I don’t have a bank account?

You’ll receive a mailed check between July 20–August 10.

4. Will it affect my Medicare or Medicaid?

No—this payment does not impact eligibility for federal benefits.

5. When should I contact the IRS if it’s missing?

Call after August 20 if your status still shows an unresolved issue or delay.