Michigan residents may soon receive a significant financial boost through newly announced $3,000 direct payments aimed at easing the burden of rising living expenses. As part of a state-supported stimulus initiative, these payments are targeted at working families, seniors, and individuals who’ve experienced recent financial setbacks. With inflation and housing costs affecting households across the state, this program comes at a crucial time.

Who Is Eligible for the $3,000 Payment?

To qualify for this direct payment, you must be a Michigan resident and meet specific income and tax criteria. Single filers must have a gross income of $85,000 or less, while joint filers should not exceed $170,000. Additionally, individuals receiving unemployment benefits, disability support, or who have dependent children may receive priority consideration. Applicants must also have filed their 2023 tax returns to be eligible.

| Eligibility Criteria | Requirement |

|---|---|

| Residency | Michigan resident |

| Income (Single Filer) | ≤ $85,000 |

| Income (Joint Filer) | ≤ $170,000 |

| Tax Return | 2023 return must be filed |

| Priority Group | Dependents, unemployment, or disability |

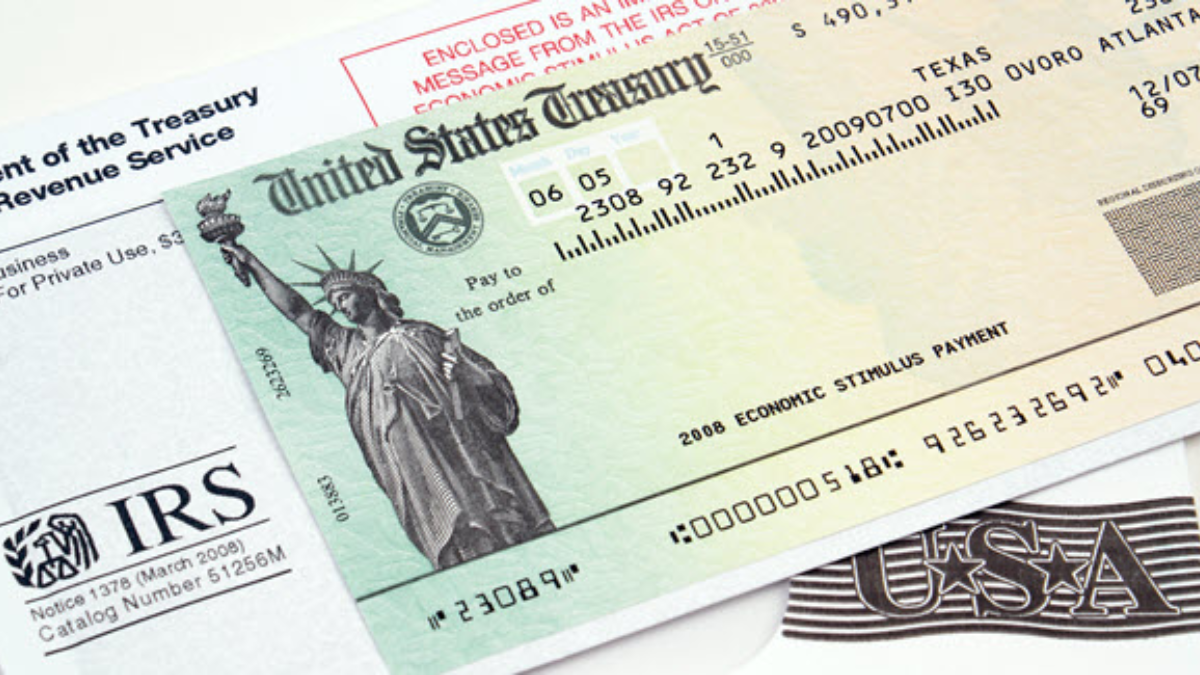

Payment Distribution Schedule

Payments began rolling out in early July 2025, and will continue in batches through September. The funds will be distributed automatically via direct deposit for those who included bank information in their tax filings. For others, paper checks will be mailed to the address listed on their most recent tax return. The payment will appear as “MI Stimulus 2025” in your bank account or on the check.

What to Do If You Haven’t Filed Yet

If you have not filed your 2023 tax return, you still have time. The deadline to qualify for the $3,000 payment is August 30, 2025. Submitting your return by this date will ensure you are included in the final round of disbursements. No separate application is required, but make sure your contact and banking details are up to date with the IRS or Michigan Department of Treasury.

Key Details to Remember

The $3,000 payment is not considered taxable income, and it will not affect your eligibility for benefits such as Medicaid, SNAP, or Social Security. Residents are advised to be cautious of fraudulent emails or calls requesting personal information—official notifications will only come from authorized state or federal departments. Always check the official website for updates on payment status.

The $3,000 direct payment program is an essential support measure for thousands of Michigan residents. Whether used for rent, groceries, medical bills, or school expenses, this financial assistance can offer real relief. Ensure that your 2023 tax return is filed and your information is accurate to avoid missing out on this one-time benefit. Act now before the deadline passes.

FAQ’s:

1. Is there an application process for the $3,000 payment?

No, if your 2023 taxes were filed and you meet the eligibility criteria, you’ll be automatically considered.

2. Will this payment affect my Social Security or unemployment benefits?

No, this payment is separate and will not interfere with other state or federal benefits.

3. When can I expect to receive my payment?

Payments are being processed from July through September 2025. Timing depends on your tax filing and banking details.

4. How do I check my payment status?

Use the Michigan Department of Treasury’s online portal to track your payment using your tax information.

5. Can non-citizens receive the payment?

Only legal residents with valid Social Security numbers who meet the criteria are eligible for this stimulus.