Texans struggling with inflation and increased costs may now benefit from a new $2,600 stimulus aid program. This financial relief is designed to support individuals and families facing hardship due to economic challenges, rising utility bills, food prices, and other household expenses. The aid is part of an effort to reduce financial pressure on working-class residents across Texas, especially those with dependents or fixed incomes.

Who Is Eligible for the $2,600 Payment?

To qualify for the $2,600 stimulus aid, you must be a Texas resident and meet certain income and tax filing requirements. Single filers must have earned $80,000 or less, while joint filers must not exceed $160,000 in annual income based on their 2023 tax return. Additionally, individuals who receive disability, unemployment, or have dependent children may receive priority. Having a valid Social Security number and a successfully filed tax return is necessary.

| Eligibility Criteria | Details |

|---|---|

| Residency | Texas resident |

| Income (Single Filer) | ≤ $80,000 |

| Income (Joint Filer) | ≤ $160,000 |

| Tax Filing | 2023 federal and state return filed |

| Priority Status | Dependents, unemployment, or disability |

How and When Will the Aid Be Sent?

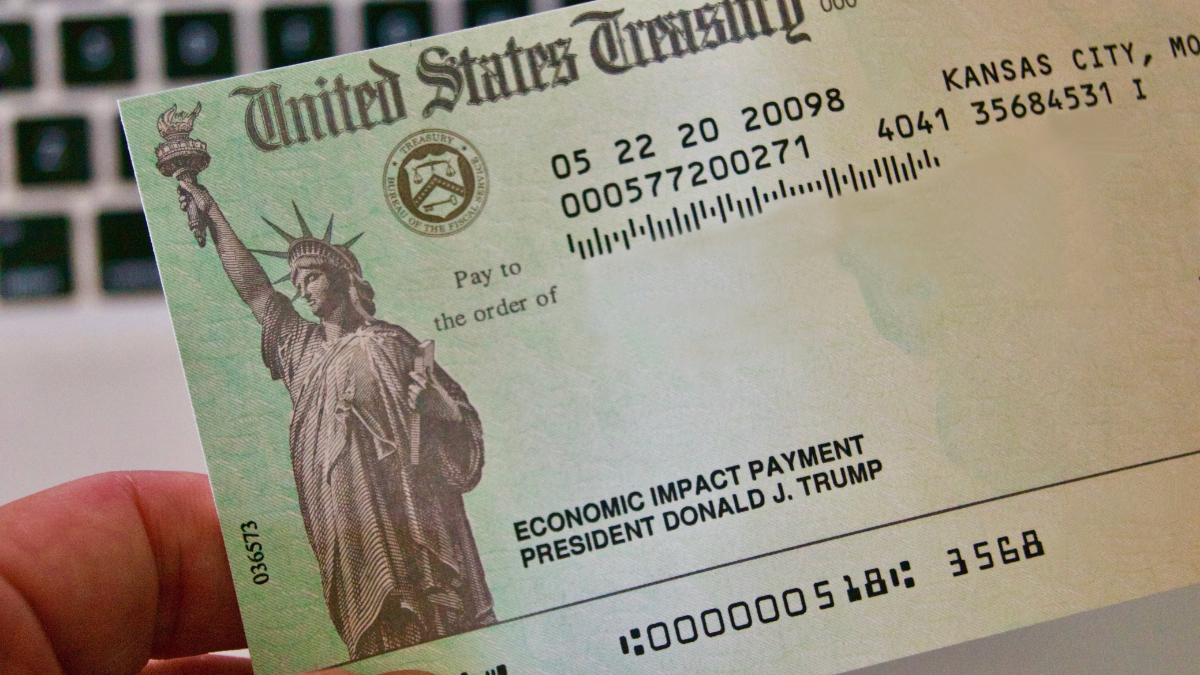

Distribution of the $2,600 stimulus began in late June 2025 and will continue into August. Most payments are being sent via direct deposit, while others will be issued by paper check to the last known address on file. Recipients should look for the payment description “TX Stimulus Relief 2025” on their bank statement. If your tax return included your banking details, you don’t need to do anything further.

What Steps to Take If You Haven’t Filed Yet

If you have not filed your 2023 tax return, you must do so by August 31, 2025 to be considered for the payment. The system automatically reviews tax records to determine eligibility, so no separate application is needed. If your contact or banking information has changed, update it through the IRS or Texas Comptroller’s official portal to avoid missing your payment.

Important Reminders for Recipients

This aid does not affect SNAP, Medicaid, Social Security, or other benefits, and it is not taxable. It’s important to beware of scams—state officials will not ask for your personal data through text or calls. Always verify payment updates through official government websites and avoid unofficial links shared online or on social media.

The $2,600 stimulus aid is a crucial support program for thousands of Texans. Whether you need help with rent, groceries, healthcare, or school supplies, this payment can help ease the financial load. Make sure your tax records and personal information are current so you don’t miss out. The deadline is approaching fast—check your eligibility and secure your payment today.

FAQ’s:

1. Is this aid taxable or will it affect my other benefits?

No, the payment is non-taxable and won’t impact your eligibility for other assistance programs.

2. Do I need to apply separately for the payment?

No separate application is needed. If you filed your 2023 taxes and meet the criteria, you’ll be considered automatically.

3. What if I changed banks or moved recently?

Update your bank or address information on file with the IRS or Texas Comptroller’s office to avoid delays.

4. When will I receive my payment?

Most payments are expected to be completed by mid-August 2025, depending on your filing status.

5. How can I track the status of my payment?

Visit the official Texas relief portal or the IRS website for real-time updates using your taxpayer information.