Arizona single fathers are now eligible for a $3,100 federal IRS aid payment as part of a broader initiative aimed at supporting vulnerable family units. As costs for housing, childcare, and healthcare continue to rise, this payment provides much-needed relief for those juggling parental and financial responsibilities alone. If you’re a single father residing in Arizona, it’s time to check if your name is on the list and act quickly to receive your benefit.

Who Qualifies for the $3,100 Payment?

To be eligible, applicants must be single fathers residing in Arizona with at least one dependent child under the age of 18. Your adjusted gross income should not exceed $85,000 annually. You must have filed a 2023 tax return or submitted non-filer information with the IRS. Fathers who receive SNAP, WIC, or Temporary Assistance for Needy Families (TANF) are automatically considered for priority processing. Special consideration is also being given to disabled veterans and fathers who are full-time caregivers.

When and How Will You Get Paid?

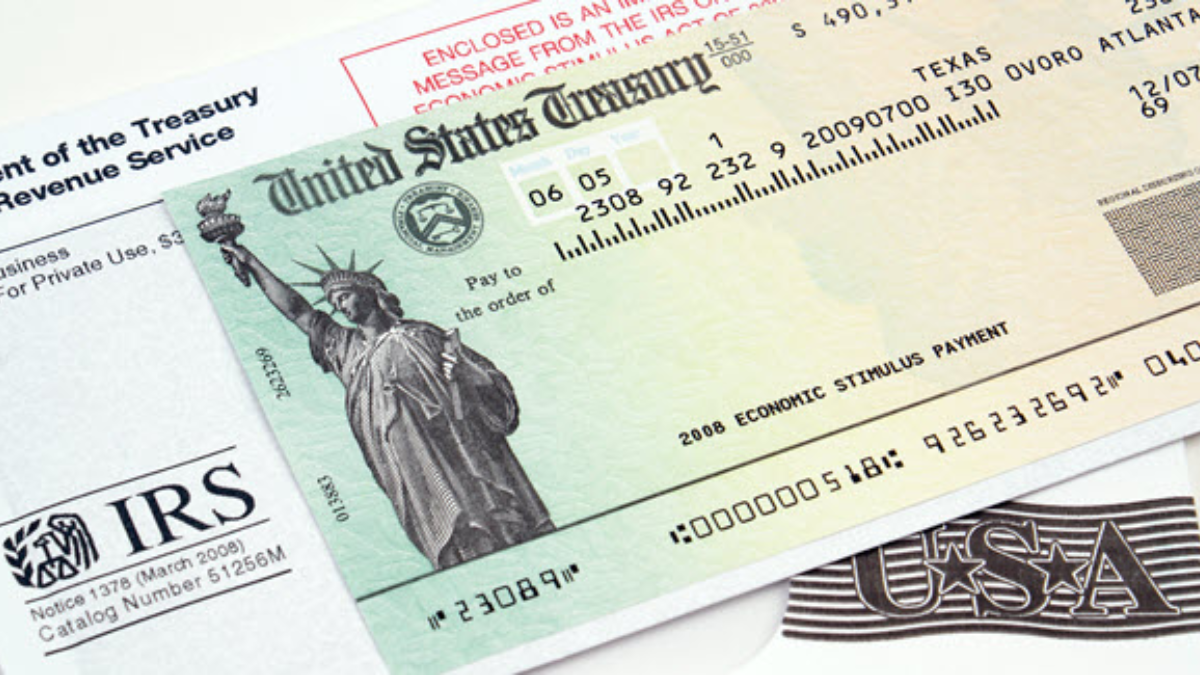

The IRS has started issuing the payments as of June 30, 2025, with the majority expected to reach bank accounts by mid-July. If you opted for direct deposit on your tax return, funds will be sent electronically. Others will receive a paper check or prepaid debit card via mail. The IRS has also launched an online status tracker where you can input your Social Security number to check payment updates. To avoid delays, ensure your banking and mailing details are correct in your IRS profile.

Quick Summary: Arizona IRS Aid for Single Fathers

| Details | Information |

|---|---|

| Payment Amount | $3,100 per eligible single father |

| Income Limit | $85,000 annually |

| Dependents Required | At least one child under 18 |

| Automatic Eligibility Programs | SNAP, WIC, TANF, SSI |

| Payment Methods | Direct deposit, check, or prepaid card |

| Payment Start Date | June 30, 2025 |

| IRS Tracking Tool | Available on official IRS portal |

| Deadline to Claim | July 31, 2025 |

The $3,100 IRS aid payment can make a meaningful difference for Arizona’s single fathers who are managing both parenting and financial responsibilities. This targeted support aims to reduce economic stress and ensure children in single-parent households receive the care and stability they need. If you meet the criteria, act swiftly—verify your details, check your payment status, and ensure you claim your benefit before the July 31 deadline. This is one opportunity you don’t want to miss.

FAQ’s:

1. Do I have to apply separately for this IRS aid?

No separate application is needed if you’ve filed your 2023 tax return. If not, submit your information through the IRS non-filer tool.

2. Can divorced fathers who share custody qualify?

Only the parent who claims the child as a dependent on their tax return is eligible to receive the aid.

3. Will this payment affect my regular tax refund or benefits?

No, the aid is separate and does not count as taxable income or affect your refund.

4. What if I didn’t receive any stimulus payments before—am I still eligible?

Yes, past ineligibility for stimulus payments doesn’t impact this program if you meet the current criteria.

5. What should I do if I don’t receive my payment by July 15?

Use the IRS tracking portal or call the IRS support line to report the issue and verify your eligibility.